Interest Rate Predictions UK 2025

Table of Contents

ToggleInterest Rate Predictions

Interest rates are one of the most important factors in deciding whether to invest in a certain asset or not. In this article, we will examine the interest rates predictions for the UK by 2025.

Interest rates are a key indicator of the health of an economy. They are one of the most influential factors in determining the value of investments and savings.

The Bank of England is responsible for setting interest rates in the UK. The current base rate stands at 3.5%. This means that banks are obliged to charge customers with a mortgage and other loans 3.5% more than they would be charged if they were borrowing at the base rate, which is often referred to as “the cost of money”.

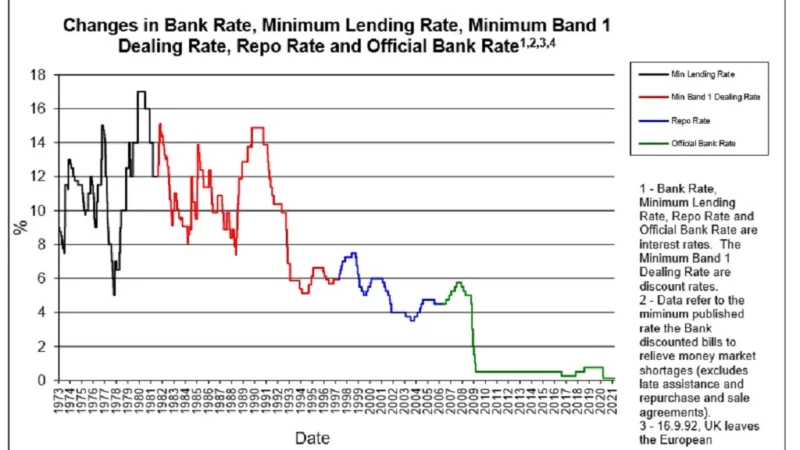

Interest rates in the UK have been on a downward trend since 2009, when they were cut to 0.5%. The Bank’s latest prediction is that interest rates will stay at this level until 3 years from now, 2024.

The Bank sets interest rates so that people will borrow more and save less, which increases demand for goods and services and stimulates economic growth.

Mortgage rates predictions UK 2024-2025

The mortgage market is one of the most important financial markets in the world. In 2017, it was worth around £1.5 trillion, or about 10% of UK GDP. It is also a very competitive market with many different providers offering different rates and mortgage deals.

We have come up with some predictions for the mortgage rates in UK from 2023-2024 based on various data sources such as Bank of England, FTSE 100 and Royal Institution of Chartered Surveyors (RICS).The predicted change in the mortgage rates is due to many factors such as:

1) The Brexit vote and its effect on the pound. This will make it more expensive for people to buy houses in the UK because they need more money than before.

2) The interest rate hike by Bank of England which will make it more expensive for people to borrow money for mortgages.

3) The changes in Stamp Duty which makes it cheaper for first time buyers who have less than £300,000 of savings and don’t own property elsewhere.

How high will interest rates go UK?

Interest rates are the price of borrowing money. The Bank of England sets interest rates and changes them every month to make sure that the economy is running smoothly.

Interest rates are the prices that banks charge on loans to their customers. They are usually expressed as a percentage of the amount borrowed.

The Bank of England is responsible for setting interest rates in the UK and is obliged to keep them within a certain range set by the government.

Interest rates can go up or down depending on what is happening in the economy and therefore, couldn’t be predicted with accuracy. If they go up it will mean that people will have to pay more to borrow money, and if they go down it will mean that people can borrow money at a lower rate of interest.

Projected interest rates in 5 years UK

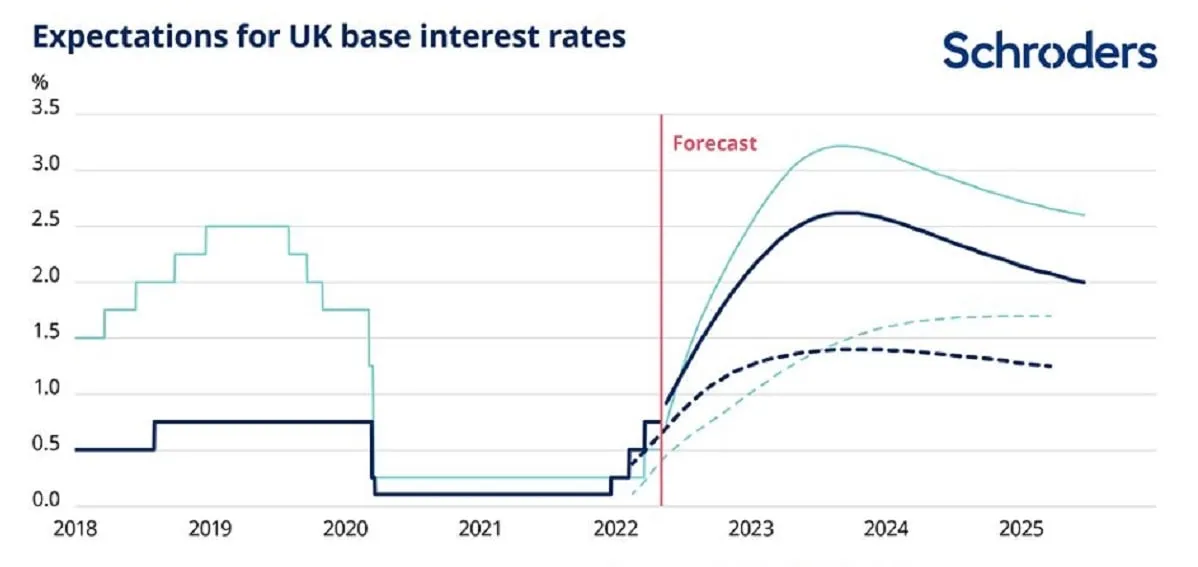

According to the Bank of England, the interest rates are expected to rise in the UK. The interest rates are projected to be at 1.5%.

The interest rates were at 0.25% in 2009 and have gone up by 0.75% since then. The Bank of England believes that this trend will continue.

The projected interest rates in the UK are typically higher than those in the US.

Interest rates can be projected by looking at the current yield curve and forecasting what will happen in the future. The yield curve is a graph of yields on bonds with different maturities, which shows how much investors are willing to pay for higher-yielding investments.