Natwest For Intermediaries Criteria

Table of Contents

ToggleNatwest

Natwest for intermediaries is an initiative by Natwest Bank to provide a platform that helps businesses get access to credit.

It is a partnership between NatWest and UK Trade & Investment. The criteria required for this partnership are very specific, which is why it’s only available for certain types of businesses in the UK.

Natwest has a unique way of finding the best match for their clients. They use a series of criteria that include:

- A person’s experience in the industry

- Their level of expertise

- Their geographical location

- The size of the company they work for

- How many intermediaries they recommend

- Intermediary quality standards

- Quality of customer service

- Quality of the intermediary’s website and marketing materials.

The aim of this initiative is to provide a platform for intermediaries to showcase their skills and grow their business. The first step towards achieving this goal is by applying for the Natwest for intermediaries programme by calling natwest for intermediaries contact number.

Natwest for intermediaries products

Natwest has partnered with financial technology companies such as Fidor and Monzo to offer their services through the NatWest for Intermediaries platform. They have a wide range of products such as savings and investment accounts, loans, personal loans, mortgages and insurance.

Natwest mortgage lending criteria defaults

The criteria for natwest mortgage lending criteria defaults are as follows:

- The customer must be aged 25 or over

- The customer must have a UK permanent address

- The customer must have a UK bank account

- The customer’s credit score must be above 700.

Natwest mortgage lending criteria CCJ

Natwest Mortgage Lending Criteria is a set of guidelines that banks use to assess the credit-worthiness of potential borrowers.

It is meant for intermediaries who have been turned down by mainstream lenders.

Thecriteria is divided into five categories:

- Income and employment history

- Current financial position

- Credit history

- Characteristics of the property

- Ability to repay

NatWest intermediaries major criteria for mortagage are as follows:

- A minimum of 75% of the property value must be owned outright.

- The mortgage must not exceed 80% of the property value.

- The property must be in a location that is deemed suitable for residential purposes.

- The mortgage must not exceed £500,000 in value.

Is natwest good for mortgages

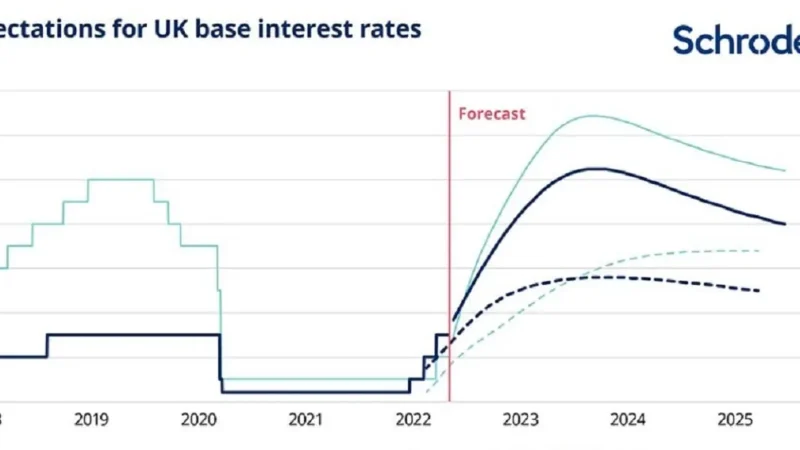

Natwest is one of the best options for home loans because it offers competitive rates, flexible repayment options and easy access to funds. It also gives customers access to services like Natwest Mortgage Protection Plan, which provides cover for unexpected costs like interest rate hikes.

It is also one of the most affordable banks for people looking for mortgages in the UK.It’s a good option if you want to get a mortgage quickly and don’t mind paying a higher interest rate than other banks offer.

They have branches around the country and they are easy to contact by phone or email. They also have an extensive range of products that are tailored towards different needs – from mortgages to savings accounts and more.

Takeaway:

Natwest is the UK’s largest mortgage lender, with over £200 billion in mortgage loans outstanding. It has offices across the UK and it is one of the top three lenders in the country for home loans.

The Natwest for intermediaries criteria for mortgage is a specific set of rules that bank uses to determine whether they will lend money to an intermediary or not. The purpose of this criteria is to protect borrowers from getting into debt with a loan shark and getting into a cycle where they can’t repay their debts.