Are Mortgage Rates Going Down UK ?

The answer is YES.

Mortgage rates are on a downward trend since the Brexit referendum in 2016 and this trend is expected to continue as the UK economy continues to grow.

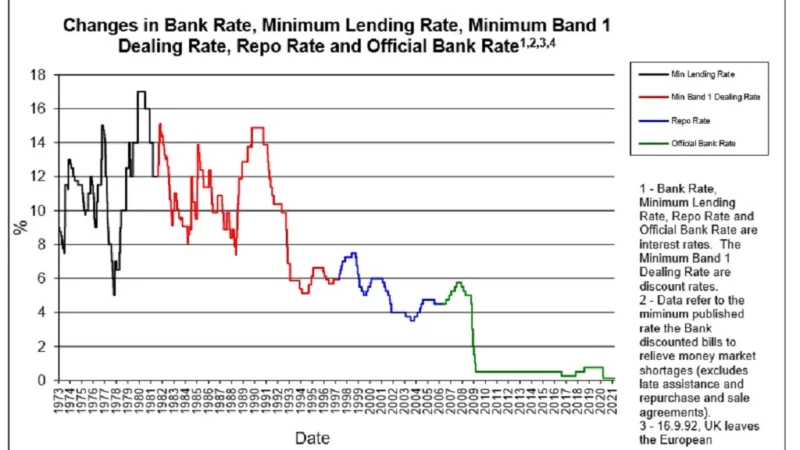

Interest rates are a key factor when it comes to determining mortgage rates, and they have been declining for quite some time now, which has led many experts to believe that mortgage rates will continue to fall in the future.

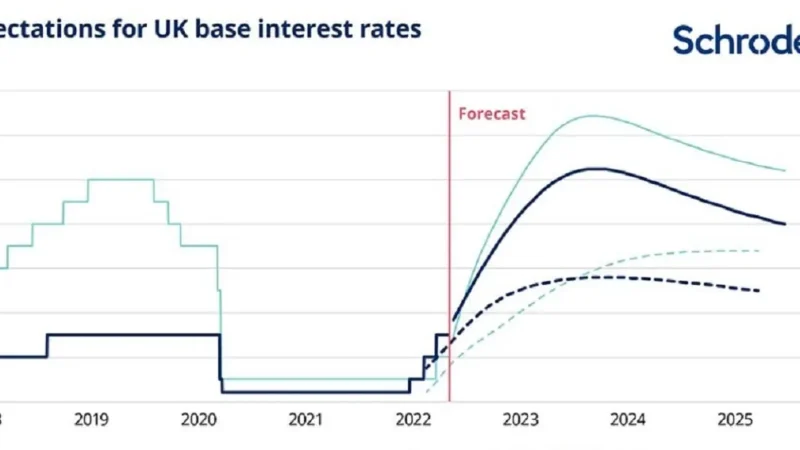

The average UK mortgage rate is predicted to rise to 4.1% by the end of 2022, according to the Bank of England’s projections for interest rates.

The Bank of England (BOE) has also cut its base rate, and mortgage rates are expected to follow suit. The BOE’s decision was taken following a sustained period of economic growth, with inflation also now at its highest level in four years. However, it is important to note that these cuts will only affect new mortgages as they have not been passed on yet by lenders.

Reasons for mortgage rates falling UK

The reason behind UK mortgage rates going down is the Bank of England’s reducing the base rate to 0.5%. Now, lenders are reducing their mortgage rates to follow suit and make it easier for people to buy homes.

The Bank of England has announced that they will be cutting interest rates from 0.25% to 0.5%. The goal is to stimulate the economy and encourage more borrowing and spending by households, which should help with economic growth in the country.

Another factor that may be contributing to this decrease is an economic rebound post-election year, which has caused interest rates on mortgages, as well as home loans, to go down too.

The mortgage market is more competitive than ever before, which means that there is a huge variety of mortgages to choose from. But this has caused rates to be higher than they were in the past.

The mortgage rates will be going up soon because of inflation. Inflation is a measure of how much prices are rising and it is measured by comparing how much prices have gone up in a year to how much they were last year. The inflation has been low for a long time but it is beginning to rise again which means that the mortgage rates will go up too.

Larger longer later mortgage

Mortgage rates are usually lower for shorter term mortgages such as 1-5 years, but they can be higher for longer term mortgages such as 15-20 years.

The government has announced plans to make it easier for people to get a mortgage. The new scheme will be called “Larger, longer, later”.

It will allow people to borrow more and pay back the loan over a longer period of time. This is designed to help those who are struggling with repayments but are not in arrears or facing repossession.

The Larger, Longer, Later scheme will be open for anyone who has been on the same mortgage deal for three years or more and can show they have been making their payments on time. It will also be available for those who have been in arrears or facing repossession but are now back up-to-date with their payments.

This new policy is expected to come into force next year and should help around 100,000 people across England and Wales every year.

To sum up:

The mortgage rates are at its lowest in the last 10 years. The interest rates are at a low point and it is likely that they will increase in the future. The average 20 year mortgage rate is 3.8% while the average 30 year mortgage rate is 4.3%.