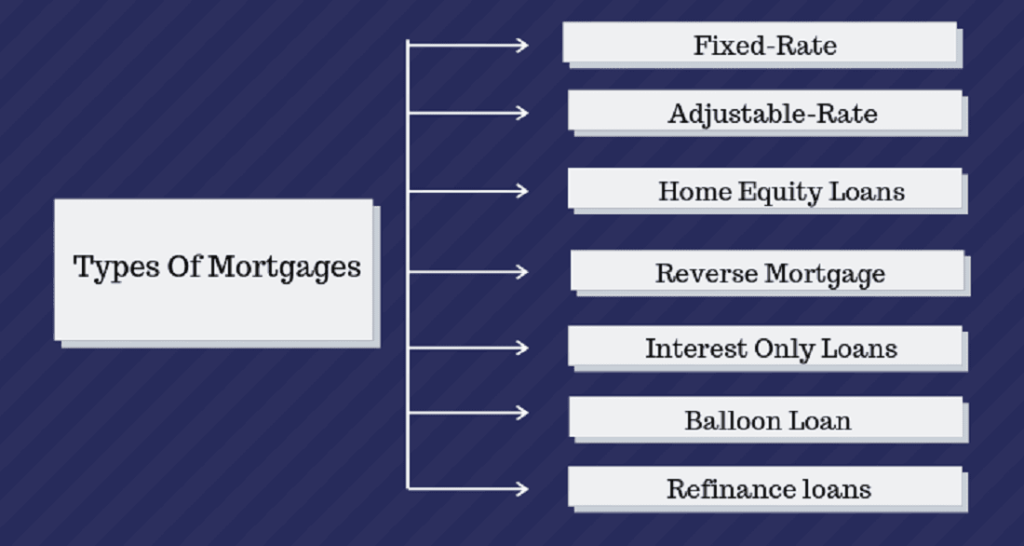

Different Types of Mortgages Explained

Table of Contents

ToggleMortgages Types

Many types of mortgage are available in today’s market, and knowing which one you need to apply for is essential to get the right deal.

Though all types of mortgages function similarly, factors like interest rates, repayment methods, and fees can differ between products. Because of this, finding the best deal isn’t simply a case of choosing the lowest rate, but more about finding the right mortgage to suit your financial situation.

To help you get up to speed, we’ve put together this guide to explain different types of mortgage available in the UK and discuss their pros and cons. Firstly, we’ll look at the differences between repayment and interest-only mortgages, the main predominant types you need to know about. We’ll then move onto variable and fixed-rate mortgages, both repayment mortgage types. In the UK, navigating the various mortgage options can be overwhelming. Here’s a breakdown of some common types to help you understand their key features:

- Buy-to-let mortgages

- Capped-rate mortgages

- Discount mortgages

- Flexible mortgages

- Guarantor mortgages

- Right to Buy mortgages

- Joint mortgages

- Offset mortgages

- Standard variable rate mortgages

- Tracker mortgages

- 95% mortgages

- Commercial Mortgage

By Repayment Method:

When it comes to mortgages, understanding the different repayment methods available is crucial for making an informed decision about which option best suits your financial situation and homeownership goals. Here’s a breakdown of the two main types categorized by their repayment methods:

What is Repayment Mortgages

Repayment mortgages remain the most popular route to homeownership in the UK, offering a clear path to owning your property outright.

How Repayment Mortgages Work:

Each monthly payment comprises two parts:

- Capital: This portion directly reduces the loan amount you owe, gradually increasing your ownership stake in the property.

- Interest: This is the lender’s charge for borrowing the money, decreasing as the outstanding capital decreases.

As you make regular payments, the capital repayment portion grows, and the interest portion shrinks. By the end of the mortgage term, you’ll have fully repaid the loan and gained complete home ownership.

Types of Repayment Mortgages:

Within the umbrella of repayment mortgages, various options cater to different needs and preferences:

- What is Fixed-Rate Repayment:

Picture owning your home with one steady monthly payment, no matter what interest rates do. That’s the power of fixed-rate repayment mortgages. Each month, you chip away at your loan (capital) and pay interest. As the capital shrinks, you gradually own more of your home. The magic touch? The interest rate is locked in for a set period, usually 2-5 years. So, your monthly payments stay the same even if interest rates go wild.

Think of it as budgeting bliss – no surprises, just one predictable expense you can easily plan for. Plus, you get peace of mind knowing you’re shielded from sudden interest rate hikes. And if rates fall? You still keep that sweet locked-in lower rate.

But no mortgage is perfect:

- You might miss out if interest rates drop and you’re stuck with a higher rate.

- Want to pay off your mortgage early during the fixed-rate period? There might be fees.

- Fixed rates usually start higher than some variable-rate options.

Who rocks this type of mortgage?

- First-time buyers who love stability and predictable budgets.

- Folks who prefer knowing their exact monthly costs, no surprises.

- Borrowers planning to stay put for the fixed-rate term or longer.

What is Tracker Repayment:

Tracker repayment mortgages bring an element of unpredictability to the homeownership journey. Your interest rate isn’t fixed, but instead, it “tracks” the Bank of England base rate, meaning it can go up or down depending on the market. While it might sound risky, let’s explore the key points:

How it Works:

- Imagine your interest rate as a car tethered to the Bank of England base rate rollercoaster. When the base rate rises, your interest rate and monthly payments climb. But worry not; if the base rate falls, your payments drop, too!

Advantages:

- Lower Rates: If the base rate dives, you could enjoy lower monthly payments than fixed-rate mortgages.

- Flexibility: No fixed rate means you could benefit from future interest rate reductions.

- Smaller Down Payment (Sometimes): Some lenders offer more favorable terms with lower payment requirements for tracker options.

Disadvantages:

- Budgeting on a Rollercoaster: Fluctuating payments can make budgeting a challenge.

- Rising Rates, Rising Worries: If the base rate soars, your payments could become a burden.

- Availability and Eligibility: Not all lenders offer tracker mortgages, and they might be stricter with their eligibility criteria.

Who Should Consider It?

- Those comfortable with some risk who believe interest rates are more likely to fall.

- Individuals with flexible budgets who can adjust their spending if payments increase.

- Those seeking lower initial rates than fixed-rate options understand the risk-reward tradeoff.

- What is Discount Repayment:

Discount repayment mortgages offer an initial perk: a reduced interest rate for a set period, typically 2-5 years. Sounds tempting, but before you jump in, let’s unpack the details:

How it works:

- You get a lower interest rate than the lender’s standard variable rate (SVR) for a fixed period.

- After the discount period ends, your rate jumps to the SVR, which can fluctuate based on market conditions.

- You make monthly repayment payments, reducing capital (loan amount) and interest.

Pros:

- Lower initial payments: Enjoy potentially lower monthly payments during the discount period, making budgeting easier.

- Flexibility: This can be a good option if you plan to sell your property before the discount ends or refinance for a better deal later.

- May require smaller down payment: Some lenders offer more favourable terms with lower down payment requirements for discount options.

Cons:

- Rate shock after discount: Be prepared for potentially significant payment increases when the SVR kicks in.

- Unpredictable future costs: Budgeting can become difficult after the discount ends, as your payments depend on the variable SVR.

- Not ideal for long-term ownership: If you plan to stay in your property long-term, the higher SVR after the discount could become a burden.

Who should consider it?

- Borrowers with limited upfront budget who benefit from lower initial payments.

- Individuals planning to sell their property within the discount period.

- Those comfortable with managing potentially higher payments after the discount ends.

- What is Offset Repayment:

Offset repayment mortgages offer a unique approach to homeownership by linking your savings account to your mortgage. This connection reduces the interest you pay, potentially saving you money.

How it works:

- You link your savings account (or multiple accounts) to your mortgage.

- The balance in your linked savings accounts offsets the outstanding loan amount of your mortgage.

- You only pay interest on the remaining mortgage balance, not the offset amount.

- Make regular repayment payments to reduce the capital amount and further decrease your interest charges.

Pros:

- Lower interest costs: Since you’re not paying interest on the offset amount, you could save money compared to traditional mortgages.

- Flexibility: You can easily add or remove funds from your linked savings accounts without affecting your mortgage agreement.

- Tax benefits (possible): Sometimes, you can claim tax relief on the interest you don’t pay due to the offset.

Cons:

- Limited earning potential: Your savings in the linked accounts won’t earn interest.

- Higher initial deposit: Lenders might require a larger down payment for offset mortgages.

- Less accessible: Not all lenders offer offset mortgages, and eligibility criteria can be stricter.

Who should consider it?

- Individuals with substantial savings they don’t need immediate access to.

- Borrowers who prioritize paying down their mortgage faster and saving money on interest.

- Those comfortable with potentially lower returns on their savings in exchange for reducing mortgage interest.

Additional Considerations:

- Mortgage Term: Choose a term that aligns with your financial goals and affordability. Longer terms offer lower monthly payments but higher overall interest costs.

- Repayment Method: Explore options like increasing your monthly payments or making lump sum contributions to accelerate capital repayment and potentially save on interest.

- Early Repayment Charges: Some lenders charge penalties for early repayment, especially during fixed-rate periods. Factor this into your decision.

- Down Payment: While not always mandatory, a larger down payment reduces the loan amount, leading to lower monthly payments and potentially more favorable interest rates.

Who are Repayment Mortgages for?

This type of mortgage suits individuals who:

- Prioritize full ownership of their home.

- Seek budgeting stability with predictable monthly payments.

- Have the financial capacity for a larger down payment and higher monthly payments.

- Value the security and benefits of building equity in their property.

Interest-Only Mortgages

Less common, you only pay the interest each month, requiring a separate investment plan to repay the original loan amount at the end. Suitable for specific scenarios with professional advice.

What is Interest-Only Mortgages

Interest-only mortgages require you to pay only the interest on the borrowed amount each month. The loan principal remains unpaid, needing to be settled in full at the end of the mortgage term, usually by selling the property or using other funds.

Types of Interest-Only Mortgages

- Standard Interest-Only: The interest rate can be fixed for a set period or variable, fluctuating with market conditions.

- Designed for older borrowers nearing retirement, requiring proof of a solid plan to repay the capital at the end (e.g., selling the property, inheritance).

Pros:

- Lower monthly payments: Your monthly outgoings are considerably lower than repayment mortgages, easing cash flow management.

- Potential for investment: You can use the difference in payments to invest elsewhere, potentially generating returns to cover the future capital repayment.

- Increased affordability: May open doors to more expensive properties you wouldn’t otherwise qualify for with a traditional mortgage.

Cons:

- Higher overall cost: You pay more interest in the long run since you’re not reducing the capital.

- Risk of not repaying the capital: You could lose your home if you can’t sell the property or access funds to repay the capital.

- Stricter eligibility criteria: Lenders view these mortgages as riskier and often require larger down payments and more stringent income assessments.

Who should consider it?

- Investors with strong financial plans and alternative ways to repay the capital at the end.

- Individuals with limited income who need lower monthly payments to qualify for their dream home.

- Borrowers nearing retirement with significant assets or guaranteed future income to cover the capital repayment.

What is Standard Interest-Only:

A standard interest-only mortgage requires you to pay only the interest portion of the loan amount each month. Unlike traditional mortgages, where you chip away at the principal, the loan amount remains unpaid throughout the term. This means you must repay the entire original loan amount (capital) in full at the end, usually by selling the property or using other funds.

Key Features:

- Interest rate: Can be fixed for a set period (e.g., 2-5 years) or variable, fluctuating with market conditions.

- Term: Typically shorter than traditional mortgages (e.g., 10-25 years).

- Eligibility: Stricter than traditional mortgages due to the higher risk involved. Larger down payments and higher income requirements are common.

Pros:

- Lower monthly payments:You pay significantly less than repayment mortgages, offering greater flexibility in cash flow.

- Potential for investment:The saved money from lower payments can be invested elsewhere, potentially generating returns to cover future capital repayment.

- Increased affordability:Opens doors to more expensive properties you wouldn’t qualify for with a traditional mortgage.

Cons:

- Higher overall cost:You pay more in total interest because you’re not reducing the capital.

- Risk of not repaying the capital:If you can’t sell the property or access funds to repay the capital at the end, you could lose your home.

- Stricter eligibility:Requires strong financial standing and a solid plan for future capital repayment.

Example:

Imagine you buy a house for £250,000 with a 20% down payment (£50,000), leaving a loan amount of £200,000. You opt for a standard interest-only mortgage with a 5% interest rate fixed for 10 years.

- Monthly interest payment: (5% interest rate / 12 months/year) * £200,000 = £833.33

- Compared to a repayment mortgage: Your monthly payment could be significantly lower than one with principal repayment, offering more financial flexibility during the fixed-rate period.

What is Lifetime Interest-Only:

Unlike standard interest-only mortgages, lifetime versions are specifically designed for older borrowers, typically nearing retirement. You only pay the interest on the loan amount each month, with the capital remaining unpaid throughout your lifetime. The loan must be fully repaid upon death or when you permanently move into long-term care.

Key Features:

- Age requirement: Usually open to those over 55 or 60 years old.

- Repayment trigger: Loan is repaid upon death or permanent move to long-term care.

- Interest rate: Can be fixed for life or variable, fluctuating with market conditions.

- Eligibility: Stricter than traditional mortgages due to the higher risk. Typically requires proof of a solid plan to repay the capital upon the trigger event (e.g., inheritance, savings, sale of other assets).

Pros:

- Lower monthly payments:Compared to repayment mortgages, you benefit from significantly lower monthly outgoings, offering greater financial flexibility in retirement.

- Access to home equity:You unlock the value of your property without downsizing or selling, potentially improving your retirement finances.

- Inheritance potential:Heirs inherit the property free of the mortgage (assuming it’s repaid from the estate or other sources).

Cons:

- High overall cost:You pay more in total interest because you need to reduce the capital.

- Uncertain repayment:Repayment relies on future events and market conditions, which can be unpredictable.

- Stress for heirs:Heirs might face the burden of repaying the capital, potentially requiring them to sell the property.

Example:

Imagine a 65-year-old retiree inherits a valuable house worth £300,000. They lack the income for a traditional mortgage but want to access the equity to improve their retirement lifestyle. They opt for a lifetime interest-only mortgage with a 4% fixed interest rate.

- Monthly interest payment: (4% interest rate / 12 months/year) * £300,000 = £1000

- Compared to a repayment mortgage: Their monthly payment is significantly lower than one with principal repayment, freeing up more retirement income.

2- By Interest Rate

Choosing the right mortgage goes beyond finding the perfect home – it’s about selecting the loan that best fits your financial situation and goals. One crucial aspect to consider is the interest rate, which significantly impacts your monthly payments and overall borrowing costs. Here are different types of mortgages categorized by their interest rate structures:

What is Fixed-Rate Mortgage

With a fixed-rate mortgage, the interest rate you lock in at the beginning of the loan term remains constant for the entire duration, usually 15-30 years. This means your monthly payments stay the same, making budgeting easier and providing peace of mind, regardless of fluctuations in market interest rates.

Key Features:

- Fixed interest rate: The agreed-upon rate at the start doesn’t change throughout the loan term.

- Predictable payments: Your monthly payment amount remains consistent, simplifying budgeting and financial planning.

- Peace of mind: You’re protected from rising interest rates affecting your payments during the fixed term.

- Potential lower rates: If market rates fall after you lock in your rate, you benefit from the secured lower rate.

- Longer terms available: Compared to some variable-rate options, fixed-rate mortgages often come with longer term lengths, offering more time to pay off the loan.

Example:

Imagine you buy a house for £250,000 with a 20% down payment (£50,000), leaving a loan amount of £200,000. You secure a fixed-rate mortgage with a 4% interest rate for a 25-year term.

- Monthly payment: The lender calculates your monthly payment based on the loan amount, interest rate, and term. In this example, it might be around £1,021.

- Fixed for 25 years: Regardless of what happens to market interest rates in the next 25 years, your monthly payment of £1,021 will remain the same.

What is a Tracker Mortgage

A tracker mortgage links your interest rate to a base rate, typically the Bank of England base rate, with an added margin set by the lender. This means your interest rate fluctuates with the base rate, impacting your monthly payments. However, unlike other variable-rate options, no introductory discount period is involved.

Key Features:

- Interest rate: Tracks a base rate (e.g., Bank of England base rate) plus a lender’s margin.

- Fluctuating payments: Your monthly payments go up or down based on the base rate movements.

- Transparency: The link to the base rate provides clear visibility into potential payment changes.

- Lower initial rates: Often start with lower interest rates compared to fixed-rate mortgages of the same term.

- Flexibility: You can usually switch to a different tracker or fixed-rate mortgage without penalties after a set period (e.g., 2 years).

Example:

Imagine you buy a house for £300,000 with a 25% down payment (£75,000), leaving a loan amount of £225,000. You choose a tracker mortgage with a 2% margin above the Bank of England base rate, which is currently 0.5%.

- Initial interest rate: 2.5% (0.5% base rate + 2% margin)

- Monthly payment: The lender calculates your monthly payment based on the loan amount, interest rate, and term. In this example, it might be around £1,109.

- Tracking the base rate: If the base rate rises to 1%, your interest rate becomes 3% (1% base rate + 2% margin), and your monthly payment would increase accordingly. Conversely, a base rate drop to 0.

What is Variable-Rate Mortgages

Variable-rate mortgages, also known as adjustable-rate mortgages (ARMs), offer a different path to homeownership than fixed-rate options. Unlike fixed-rate mortgages, where the interest rate remains constant, variable-rate mortgages fluctuate periodically based on a reference rate (e.g., Bank of England base rate) and the lender’s margin. This means your monthly payments can go up or down, impacting your budget and financial planning.

Key Features:

- Variable interest rate: Fluctuates based on a reference rate and lender’s margin.

- Potential for lower payments: If the reference rate stays low, you might enjoy lower payments than fixed-rate mortgages.

- Potential for higher payments: If the reference rate increases, your payments could rise, impacting your affordability.

- Different types: Several variations exist, including tracker mortgages, discount mortgages, and offset mortgages, each with different rate adjustment structures.

- Flexibility: Some options offer flexibility to switch to a fixed-rate mortgage after an initial period.

Example:

Imagine you buy a house for £200,000 with a 20% down payment (£40,000), leaving a loan amount of £160,000. You choose a tracker mortgage with a 2% margin above the Bank of England base rate, which is currently 0.5%.

- Initial interest rate: 2.5% (0.5% base rate + 2% margin)

- Monthly payment: The lender calculates your monthly payment based on the loan amount, interest rate, and term. In this example, it might be around £816.

- Rate adjustments: If the base rate rises to 1%, your interest rate becomes 3% (1% base rate + 2% margin), and your monthly payment would increase accordingly. Conversely, a base rate drop to 0.25% would result in a lower interest rate and payment.

3- By Deposit Amout

In the UK, mortgage types aren’t directly categorized based on deposit amount alone. However, depending on your down payment size, different mortgage options might be more suitable.

- Mortgage options based on Loan-to-Value Ratio (LTV):

- LTV 95%:These mortgages require only a 5% deposit. However, they’re rare and often come with higher interest rates, stricter eligibility criteria, and may require mortgage insurance. Options include:

*Help to Buy Equity Loan: Government-backed scheme offering a 20% loan towards your purchase, bringing your LTV down to 75%. Eligibility requirements apply.

*Guarantor Mortgages: Someone else (usually a parent or guardian) guarantees the loan, allowing you to access 95% mortgages with better rates than standard options. Be aware of the risks involved for the guarantor.

- LTV 85% – 90%:This is a more common range with more competitive rates and wider availability. Options include:

*Fixed-Rate Mortgages: Lock in your interest rate for a set period (2-5 years typically) for predictability and peace of mind.

*Tracker Mortgages: Your interest rate tracks a base rate (e.g., Bank of England base rate) plus a margin, offering potential savings if rates stay low but carrying the risk of increases.

- LTV 75% – 80%:With a 20%-25% deposit, you can access the most favorable rates and terms. Here are common choices:

*Fixed-Rate Mortgages: Popular option for stability and budgeting confidence.

*Discount Mortgages: Initial reduced interest rate for a set period, followed by reversion to the lender’s standard variable rate (SVR).

*Offset Mortgages: Link your savings account to the mortgage, effectively reducing your interest payments based on your savings balance.

- Other factors to consider:

- Your credit score: A higher credit score opens doors to better rates and terms across all LTV bands.

- Employment status: Stable employment strengthens your eligibility and potentially secures better rates.

- Income: Lenders assess affordability based on your income and outgoings.

- First-time buyer status: Some lenders offer specific schemes or discounts for first-time buyers.

4- Other Types of Mortages

If you’ve considered variable rate and fixed-rate mortgages, you may wonder whether any other types may suit your financial situation. There are several mortgages that have specialised terms that are also worth considering.

What is a Buy-to-Let Mortgages?

A buy-to-let mortgage is a specific type of mortgage designed for individuals who want to purchase a property to rent it out to tenants, generating rental income as an investment. Unlike standard residential mortgages, buy-to-let mortgages come with different terms and considerations.

A buy-to-let mortgage allows you to borrow money from a lender to purchase a property specifically for renting it out. The mortgage is secured against the property itself, meaning the lender can repossess it if you fail to make repayments.

Key Features:

- Higher interest rates: Compared to residential mortgages, buy-to-let mortgages typically have higher interest rates due to the perceived higher risk for the lender.

- Larger deposits: Lenders often require larger down payments, usually 25% or more of the property value, to mitigate their risk.

- Stress tests: Lenders may stress test your affordability, considering potential rental income alongside your regular income and outgoings.

- Tax implications: Rental income is subject to income tax, and you may have additional property tax obligations.

- Limited availability: Not all lenders offer buy-to-let mortgages, so shopping around is crucial.

Who should consider a buy-to-let mortgage?

This type of mortgage might be suitable for:

- Investors with strong financial planning and risk tolerance to handle potential fluctuations.

- Individuals with sufficient capital to cover deposits, ongoing costs, and potential vacancies.

- Those who are prepared to manage the property and deal with tenant issues actively.

What is an Offset Mortgages?

An offset mortgage combines a traditional mortgage with one or more linked savings accounts. The magic lies in how your savings work: instead of earning interest, they reduce the interest you pay on your mortgage based on your linked savings balance. In simpler terms, your savings “offset” your outstanding mortgage balance, leading to lower overall interest payments and potentially, faster repayment.

Key Features:

- Linked savings accounts: You link one or more savings accounts to your mortgage.

- Reduced interest: The balance in your linked savings accounts reduces the interest you pay on your mortgage, not earning interest itself.

- Potential benefits: Lower interest payments and faster repayment if you maintain savings in the linked accounts.

- Flexibility: You can usually access your savings in the linked accounts, but withdrawals affect your interest reduction benefit.

Example:

Imagine you have a £200,000 mortgage with a 4% interest rate and you link a savings account with a £10,000 balance. This effectively reduces your loan balance for interest calculation purposes to £190,000. So, instead of paying interest on £200,000, you’d pay on £190,000, saving you money each month and over the loan term.

Who is this type of mortgage for? Homeowners with a lot of savings that they don’t have immediate plans for, especially those in a high tax bracket. They’re also useful for those who want to help a relative who is a first-time buyer, as some lenders allow you to offset your savings so that another can access a better rate

What is a Shared Ownership Mortgages?

Shared ownership mortgages offer a unique path to homeownership by allowing you to buy a share of a property (between 10% and 75%) instead of the entire thing. You then pay rent on the remaining share to a housing association or developer, acting as your landlord. This makes homeownership more accessible with a smaller upfront cost than conventionally buying the whole property.

Key Features:

- Partial ownership: Purchase a percentage (share) of the property, usually between 10% and 75%.

- Rent on remaining share: Pay rent on the share you don’t own to the housing association or developer.

- Lower initial cost: Smaller down payment due to buying a smaller share.

- Stairs mechanism: Gradually increase your ownership share (usually in increments of 10%) over time, eventually owning the entire property.

- Leasehold ownership: Most shared ownership properties are leasehold, meaning you own the property for a set period (usually 125 years).

Example:

Let’s say you find a shared ownership property worth £200,000 and buy a 25% share for £50,000 with a shared ownership mortgage. You might pay around £200-£300 per month in rent for the remaining 75% share. As your income or financial situation improves, you can use the “stairs” mechanism to buy additional shares (e.g., another 10% for £20,000) until you eventually own the entire property (100%) and no longer pay rent.

Who is this type of mortgage for?

Shared ownership mortgages can be a good option for various individuals and situations, but it’s not a one-size-fits-all solution.

- Shared ownership offers a chance to get on the property ladder with a significantly smaller down payment compared to traditional mortgages. This can be especially helpful for individuals with limited savings or lower incomes.

- It allows them to build equity gradually through the “stairs” mechanism, eventually owning the whole property.

- While not specifically targeted at low-income individuals, shared ownership can be more accessible than traditional mortgages for those with moderate incomes who may struggle to afford the full purchase price.

- Some government schemes offer additional support for key workers, making shared ownership even more attractive for nurses, teachers, police officers, and others in similar professions.

What is a 95% mortgage?

A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, allows you to finance the purchase of a property with only a 5% down payment. This makes homeownership more accessible for those who might not have much savings upfront. However, it’s important to understand the implications before choosing this type of mortgage.

Understanding the Basics:

- Loan amount: You borrow 95% of the property’s purchase price from the lender.

- Down payment: You contribute 5% of the purchase price from your own funds.

- Higher interest rates: Compared to mortgages with larger down payments, 95% mortgages typically have higher interest rates due to the increased risk for the lender.

- Mortgage insurance: Some lenders may require private mortgage insurance (PMI) to protect themselves in case of default. PMI adds to your monthly payment.

Example:

Imagine you find a house for £200,000. With a 95% mortgage, you’d need a £10,000 down payment and borrow £190,000 from the lender. Your monthly payment will be higher than with a larger down payment due to the higher interest rate and potential PMI.

Who is a 95% Mortgage for?

This type of mortgage can be suitable for:

- First-time buyers: Those with limited savings but steady income can access homeownership without needing a large down payment.

- Individuals with other financial goals: Allows you to invest your savings in other areas while still buying a property.

- Those in high-cost areas: In markets with high property prices, saving a large down payment can be challenging, making a 95% mortgage an option.

What is a flexible mortgage?

A flexible mortgage offers greater flexibility in managing your mortgage payments compared to traditional fixed-rate or tracker mortgages. This can be beneficial for individuals with variable income or those who want more control over their finances.

Key Features:

- Payment flexibility: Options might include overpayments, underpayments, payment holidays, or switching between different payment frequencies.

- Linked accounts: Some offers may connect your mortgage to savings accounts, reducing your interest charges based on your savings balance.

- Offset feature: Similar to linked accounts, you can use funds in a linked savings account to reduce your mortgage interest directly.

- Higher interest rates: Generally, flexible mortgages come with slightly higher interest rates than standard options due to the added features and perceived higher risk for the lender.

Example:

Imagine you have a flexible mortgage with overpayment capability. You receive a bonus at work and decide to make a lump sum payment towards your mortgage, potentially reducing your overall interest payments and shortening the loan term. Alternatively, you might experience a temporary income dip and opt for a payment holiday or reduced payments for a limited period.

Who is a Flexible Mortgage for?

This type of mortgage can be suitable for:

- Self-employed individuals: Their income might fluctuate, and the flexibility allows them to adjust payments accordingly.

- Individuals with irregular income: Those with variable income streams, like freelancers or commission-based earners, can benefit from the payment flexibility.

- Borrowers seeking control: People who want more control over their mortgage payments and interest charges might find the features appealing.

- Those planning life changes: Individuals anticipating events like starting a family or taking a career break might benefit from the flexibility for future adjustments.

What is a joint mortgage?

A joint mortgage is a loan taken out by two or more people (joint borrowers) to purchase a property together. The key aspect is that all borrowers are jointly and severally liable for the entire loan amount. This means that each borrower is responsible for the full repayment of the mortgage, regardless of the contribution of the others.

Key features:

- Combined income: Allows pooling of incomes from all borrowers, potentially qualifying for a larger loan amount than individually.

- Shared ownership: All borrowers typically own the property jointly, usually in equal shares (although other arrangements are possible).

- Joint responsibility: Each borrower is equally responsible for making mortgage payments, regardless of individual circumstances.

- Credit scores: The credit scores of all borrowers are considered, potentially impacting the interest rate and eligibility.

- Exit strategies: Requires agreement and cooperation from all borrowers for selling the property or refinancing the mortgage.

Example:

Let’s say two friends, Sarah and Michael, want to buy a house together. They take out a joint mortgage for £200,000. Even if Sarah contributes £80,000 as a down payment and Michael contributes £20,000, they are equally liable for the entire £200,000 loan amount. They are both responsible for making the monthly payments and other loan obligations.

Who is a joint mortgage for?

This type of mortgage can be suitable for:

- Couples planning to share ownership: Ideal for married couples, partners, or siblings purchasing a property together.

- Individuals needing combined income: Those benefit from combining their income to qualify for a larger mortgage than possible.

- Friends or family with shared plans: Suitable for friends or family members who plan to co-own and live in the property together.

What is a guarantor mortgage?

A guarantor mortgage, also known as a family assist mortgage or parental guarantee mortgage, allows you to get a mortgage even if you have a limited deposit or a less-than-ideal credit score. This is achieved by having someone else, typically a close relative like a parent or guardian, act as a guarantor for the loan.

Key features:

- Guarantor responsibility: The guarantor promises to make the mortgage payments if you, the primary borrower, fail to do so. This safeguards the lender in case of default.

- Improved eligibility: With a guarantor’s backing, you might qualify for better interest rates and access larger loan amounts than you could get alone.

- Limited guarantor impact: The guarantor’s assets are typically not at risk unless you default on the mortgage for an extended period.

- Potential risks: If you default, the guarantor could face financial hardship, damage to their credit score, and even repossession of their property in extreme cases.

Example:

Sarah wants to buy a house but only has a 5% deposit and a fair credit score. She might need help to secure a good mortgage deal. By having her parents act as guarantors on her mortgage, she might qualify for a better interest rate and a larger loan amount, making her purchase more feasible. However, Sarah must understand that if she defaults on the mortgage, her parents’ finances and credit scores could be negatively impacted.

Who is a guarantor mortgage for?

This type of mortgage can be suitable for:

- First-time buyers: Those with limited savings or lower credit scores can access homeownership with the support of a guarantor.

- Individuals with improving credit: Those rebuilding their credit score might benefit from a guarantor’s support to secure a better mortgage deal.

- Borrowers in high-cost areas: In markets where property prices are high,

What is a Commercial mortgage?

A commercial mortgage is a loan specifically designed for purchasing or refinancing commercial property, such as office buildings, retail spaces, industrial warehouses, or apartment complexes. Unlike residential mortgages, they cater to businesses and investors aiming to acquire land or buildings for commercial purposes.

Key Features:

- Secured by the property: Similar to residential mortgages, the commercial mortgage is secured by the property itself. In case of default, the lender can foreclose and sell the property to recoup their losses.

- Larger loan amounts: Commercial mortgages typically deal with larger sums compared to residential ones, reflecting the higher value of commercial properties.

- Variety of terms: Loan terms can vary significantly depending on the property type, borrower’s creditworthiness, and lender’s policies. Terms usually range from 5 to 25 years, with amortization periods often longer than the loan term.

- Higher interest rates: Generally, commercial mortgage interest rates are higher than residential mortgages due to the perceived higher risk for lenders.

- ** stricter eligibility criteria:** Qualifying for a commercial mortgage typically requires strong financial statements, a healthy credit score, and a solid business plan for the property’s use.

Examples of how commercial mortgages are used:

- A small business owner might use a commercial mortgage to purchase a building to house their operations.

- A real estate investor might use it to acquire an apartment complex and generate rental income.

- A developer might use it to finance the construction of a new shopping mall.

Who is a commercial mortgage for?

This type of financing is suitable for:

- Businesses: Established businesses needing capital to purchase or refinance commercial property for their operations.

- Real estate investors: Individuals or entities investing in commercial properties for rental income or capital appreciation.

- Developers: Building new commercial properties like offices, retail spaces,

What is a Right to Buy mortagge?

In England and Northern Ireland, the Right to Buy scheme empowers public-sector housing tenants (council or housing association tenants) to purchase their homes at a discounted price. This discount can be significant, reaching up to 70% in some cases, making homeownership more accessible.

Key Features:

- Eligibility: You must have been a public-sector tenant for at least 3 years (5 years for flats) and use the property as your main home.

- Discount offered: The discount starts at 35% and increases by 1% for each year you’ve lived there, up to a maximum of 70% (65% in Northern Ireland).

- Mortgage considerations: While there’s no specific “Right to Buy” mortgage, lenders offer regular mortgages for these purchases. You can use your discount as your deposit, potentially reducing the loan amount and monthly payments.

- Restrictions: You can only sell the property within the first 5 years (3 years in Northern Ireland) by offering it back to the housing provider at the discounted price.

Example:

Imagine you’ve rented a council house for 10 years, and it’s valued at £200,000. You would be eligible for a 50% discount, bringing the purchase price down to £100,000. Your monthly payments might be lower than your current rent, depending on your financial situation and chosen mortgage terms.

Who is the Right to Buy scheme for?

This scheme can be beneficial for:

- Public-sector tenants: Those who want to become homeowners and benefit from potential property value appreciation.

- Individuals with limited savings: Using the discount as a deposit can lower the upfront cost of buying a home.

- Those seeking stability: Owning your home offers more stability compared to renting, especially with increasing rental costs.

We are accredited with some of the top Mortgage brokers in UK so that we can provide a solution for your finance needs. Mortgage advisory services are generally free. If you require an expert mortgage broker, then be sure to reach out to us. Click the button