How Long Will Mortgage Rates Stay High: What Should Mortgage Borrower Do in 2024-2025?

Table of Contents

ToggleHow Long Will Mortgage Rates Stay High

The UK prime minister announced new tax cuts and the market doesn’t seem to like it. The UK government has been struggling to reduce their deficit and the economy is in a slow state.

As per mortgage news UK, PM announcement of tax cuts for the middle-class was met with mixed reactions by the markets. This was due to the fact that many people thought that this would be inflationary in nature, leading to higher mortgage rates.

High mortgage rates are not just a problem for those who are struggling with affordability but also for those who are buying homes at a time when house prices have been rising steadily.

The UK mortgage market is going through a tough time. As a result, lenders have been reluctant to lend as much money as they used to and are also using mortgage lenders withdraw offers. This has led many people who were previously able to get a mortgage for their homes, into difficulties and make it harder for them to buy a home in the future.

The Negative Impact of Rising mortgage Rates on Families and Businesses

Rising mortgage rates have had a negative impact on the economy. The cost of borrowing money for mortgages/ buy to let has increased and the number of people who can afford to purchase homes has dropped.

Rising interest rates also make it difficult for businesses to borrow money and create new jobs, because it becomes more expensive for them to do so. These rates are causing a lot of problems in the UK. People are struggling to make ends meet, and businesses are struggling to stay afloat.

The rate hike is not only impacting the economy but also the people who are already struggling to make ends meet.

Why mortgage lenders withdraw offers

The main reason why mortgage lenders withdrew their offers is that they found out that borrowers were not able to repay their loans. This happened due to a number of factors including high interest rates, high loan amounts, down payment requirements and unaffordable monthly payments.

When a mortgage lender withdraws an offer, this means that it will no longer be considered for a mortgage. It can be because the buyer does not qualify for the loan, or they are not able to afford the loan payments

So will my mortgage offer be withdrawn? If you are offered a mortgage that seems too good to be true, it is likely that the lender has mortgage offer withdrawn. The reason for this is because some lenders will only offer mortgages on certain terms or in certain areas.

What are the causes of high mortgage rates?

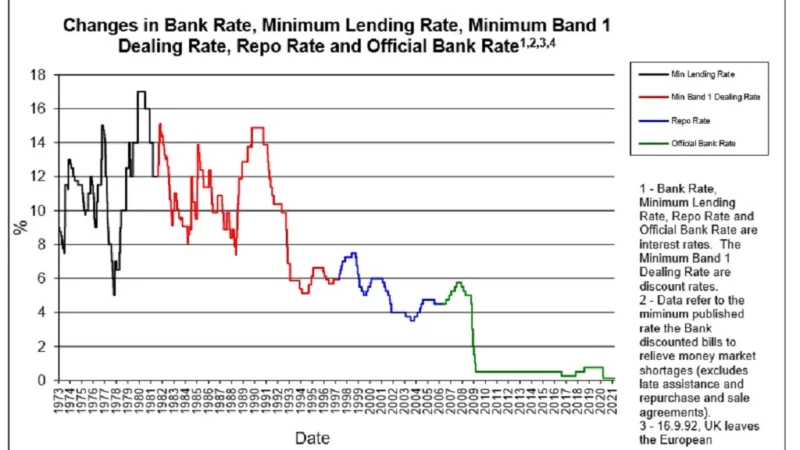

Mortgage rates have been on the rise in recent years due to a variety of factors. There are many causes of high mortgage rates, but one of the most common is inflation. Inflation can cause mortgage rates to increase because it reduces the value of money.

The high prices that result from inflation make it more difficult for consumers to afford homes and other products, which can lead to a decrease in sales and profits for companies, which then leads them to raise prices again.

Other reasons are low rate of GBP and unemployment in the economy.

Is now a great time to buy a home or invest in property in the UK?

Demand for homes has increased dramatically over the last few years, and this has led to an increase in prices for those looking to buy their first home.

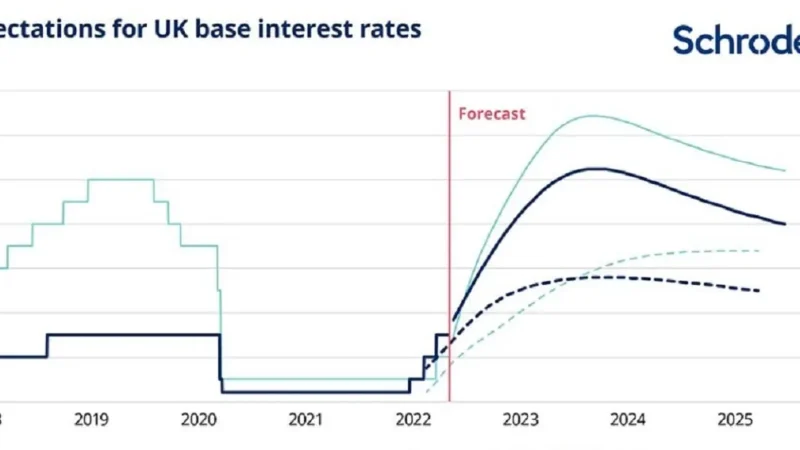

The recent increase in interest rates has had a significant impact on the housing market, especially first time buyer. With the average rate of mortgage now rising to 4.5%, it is becoming more difficult for homeowners to afford their homes. As we can see, when interest rates go up, home prices go down and vice versa which means that many people are struggling to find affordable homes nowadays.

How much will my mortgage go up?

Mortgage rates are going up and it is a big problem for many UK citizens who are already struggling with their finances.

So how much will my mortgage go up UK? Your mortgage is likely to go up in the future. This is because of the rising interest rates and a decrease in the value of your home. As a result, it’s important for you to know how much your mortgage will increase each year, so that you can plan ahead.

Should I fix my mortgage now?

This is a question that many homeowners ask themselves when they are looking to refinance or get out of their current loan.

If you’re considering refinancing, it may be worth it to wait awhile until rates and interest rates go down. If you need cash for other financial obligations, then now could be the time to fix your mortgage. However, if you have any questions about whether or not it’s worth it for you to take action on your current loan, talk with a mortgage broker before making any decisions.

How long can we expect to see low rates?

The answer depends on what you are looking for in your future home purchase. Low-interest rate loans can be a good option if you are looking at buying a home with a large down payment or if you want to buy a home with cash up front.

The government recently introduced new measures to help stimulate demand in this market, which has improved lending conditions and contributed to a reduction in mortgage rates.

The low interest rates are also expected to continue for long because they are related to the Federal Reserve’s monetary policy, which is aimed at boosting economic growth and reducing unemployment levels.

Takeaway:

The UK government has been trying to reduce its budget deficit by implementing austerity measures. The new Prime Minister has been trying to alleviate this by implementing tax cuts and increasing spending on social welfare programs.

The announcement of tax cuts has not gone down well with the market, which lead to higher interest rates.

Some experts believe that these changes will be temporary and that UK mortgage rates will return back to their normal levels in the near future.