UK Mortgage Rates History

Table of Contents

ToggleUK mortgage interest rates history-

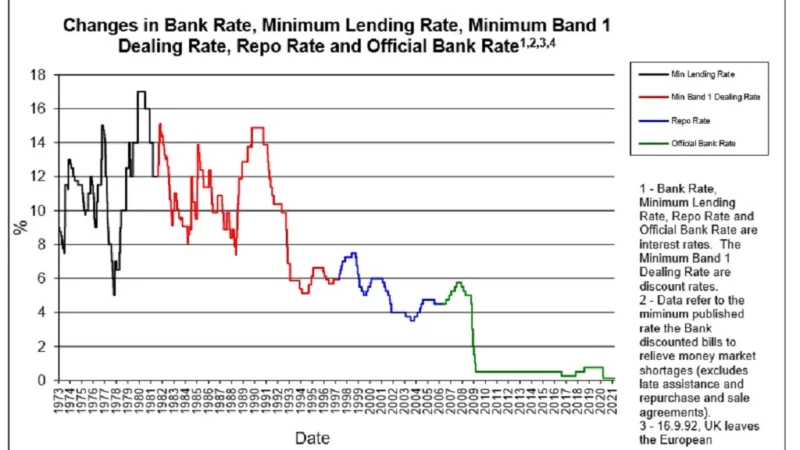

The UK mortgage market has seen significant changes over the past few decades, with interest rates fluctuating and mortgage products evolving to meet the changing needs of consumers. This blog post will explore the history of UK mortgage rates from the 1970s to the present day.

The 1970s – High-interest rates and limited options

In the 1970s, the UK experienced high inflation and interest rates, with mortgage rates averaging around 9-10%. This made it challenging for many people to get on the property ladder, and the mortgage market was limited, with very few options available. Most mortgages were offered on a variable rate basis, and no fixed-rate products were available.

The 1980s – Interest rates reach record highs

The 1980s were a turbulent time for the UK economy, with interest rates peaking at 15% in 1989. This made it incredibly challenging for people to afford mortgage repayments, and many homeowners needed help to keep up with their payments. However, fixed-rate mortgages became more prevalent towards the decade’s end, offering homeowners stability in uncertain times.

The 1990s – The rise of fixed-rate mortgages

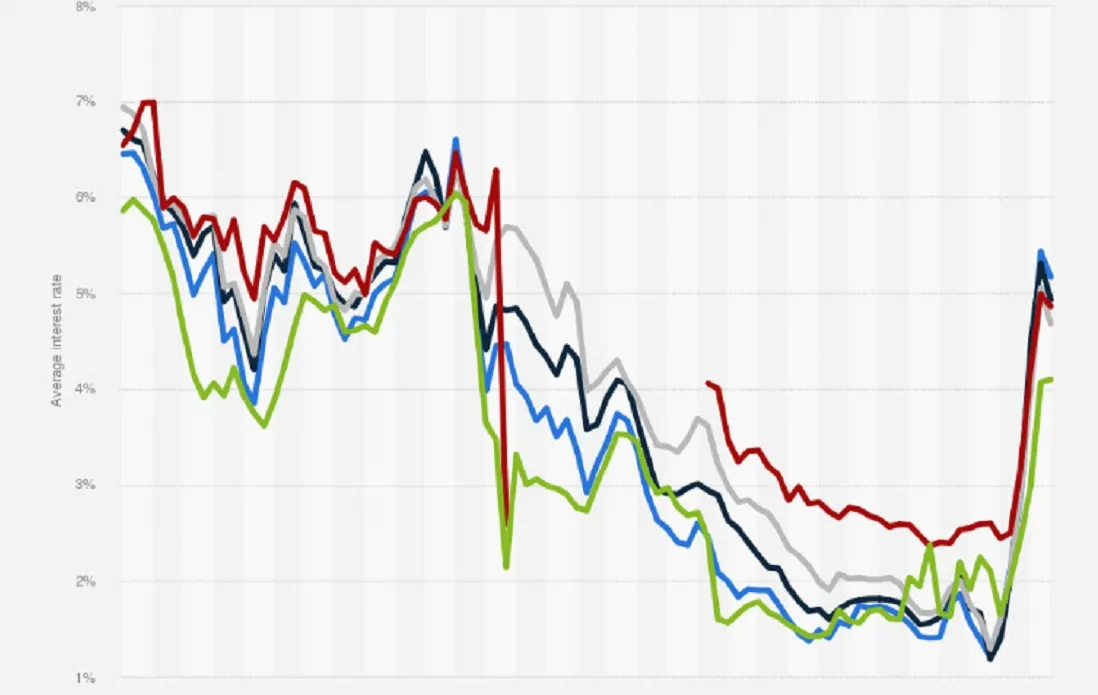

In the 1990s, fixed-rate mortgages became more popular, with many lenders offering deals lasting two or three years. This provided homeowners with more stability and predictability, and the mortgage market began to evolve to meet the changing needs of consumers. However, interest rates remained high, with many mortgages still being offered at rates of 8-9%.

The 1990s – The rise of fixed-rate mortgage

In the 1990s, fixed-rate mortgages became more popular, with many lenders offering deals lasting two or three years. This provided homeowners with more stability and predictability, and the mortgage market began to evolve to meet the changing needs of consumers. However, interest rates remained high, with many mortgages still being offered at rates of 8-9%.

The 2000s – The rise of fixed-rate mortgages

In the 2000s, fixed-rate mortgages became more popular, with many lenders offering deals lasting two or three years. This provided homeowners with more stability and predictability, and the mortgage market began to evolve to meet the changing needs of consumers. However, interest rates remained high, with many mortgages still being offered at rates of 8-9%.

The early 2000s saw a rise in subprime lending, with many lenders offering mortgages to people with poor credit histories. This led to a housing bubble, and when it burst in 2007, it caused a global financial crisis. Interest rates were reduced to record lows to stimulate the economy, with the Bank of England cut rates to 0.5% in 2009. This led to a surge in demand for fixed-rate mortgages, with many lenders offering deals lasting five or even ten years.

The 2010s –

Low interest rates and increased competitions with the Bank of England keeping rates at 0.5% until 2016, when they were reduced to 0.25% in the wake of the Brexit vote. This led to increased competition in the mortgage market, with many lenders offering competitive deals to attract customers. Fixed-rate mortgages remained popular, with many homeowners opting for deals that lasted for five or ten years to provide stability and predictability.

The 2020s – Uncertainty and low rates

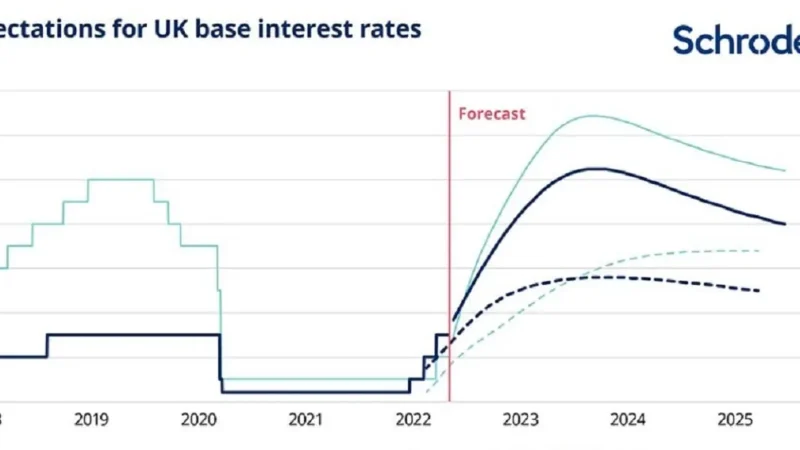

The 2020s have been marked by uncertainty, with the COVID-19 pandemic causing economic upheaval and tension in the housing market. Interest rates remain low, with the Bank of England cut rates to a historic low of 0.1% in 2020 to stimulate the economy. This has led to a surge in demand for fixed-rate mortgages, with many lenders offering deals lasting five or ten years to provide stability and predictability.

Conclusion

The UK mortgage market has seen significant changes over the past few decades, with interest rates fluctuating and mortgage products evolving to meet the changing needs of consumers. From the high rates of the 1970s to the subprime crisis of the 2000s and the uncertainty of the present day, the UK mortgage market has been shaped by economic and social factors. Fixed-rate mortgages have become increasingly popular, offering homeowners stability and predictability in uncertain times. As we look towards the future, it remains to be seen how the mortgage market will continue to evolve and adapt to meet the changing needs of consumers.