UK Mortgage Types Compared

Table of Contents

ToggleDifferent Types of Mortgage in UK: Which One is Best for You?

The UK mortgage market is quite varied with many different types of mortgages to choose from. It is important to know what type of mortgage you are looking for before you start your search. We have put together this guide to help you compare the different types of mortgage available in the UK and find out which type will suit you best.

The UK mortgage market is one of the most competitive in the world. From a variety of mortgage types to a wide range of lenders, there are many options for borrowers.

One of the most important factors for borrowers to consider when looking for a mortgage is how much they can afford to borrow. This is because the size of their monthly repayments will depend on how much they can borrow, and how much interest they will have to pay.

Types of Mortgages

There are several types of mortgages in the UK. These include:

- Fixed rate mortgages

- Variable rate mortgages

- Mortgage with a buy to let option

- Mortgage with a remortgage option

- Interest only mortgages

- Shared equity mortgage (for first time buyers)

We’ll discuss the most popular 4 i.e., Fixed& Variable and Repayment & Interest only.

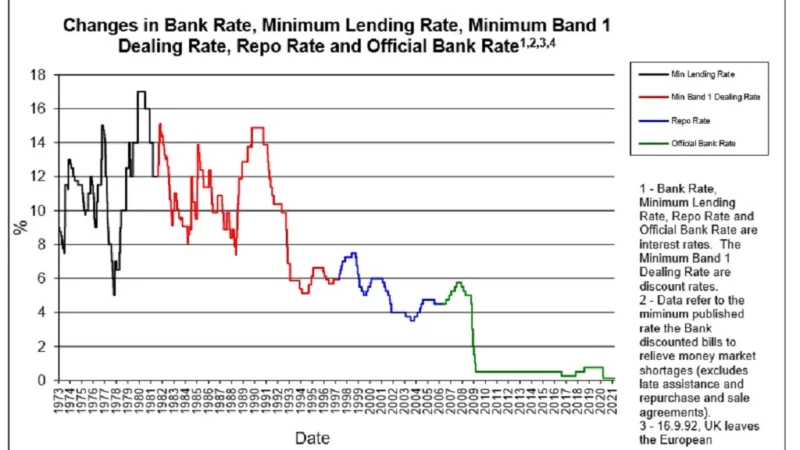

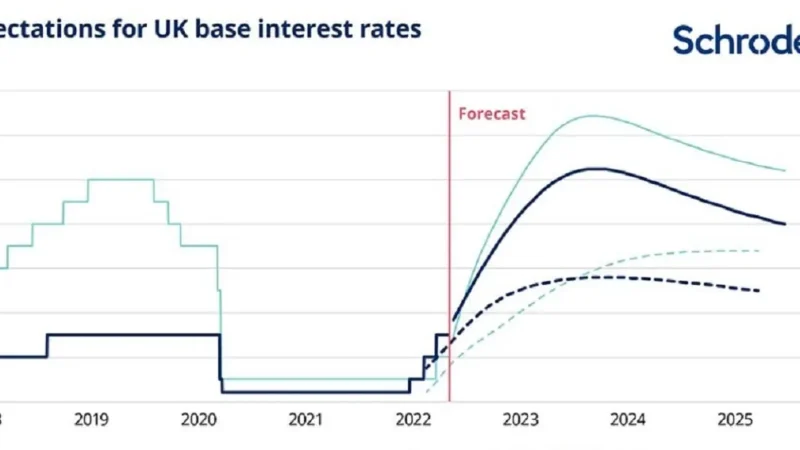

- Fixed mortgages have a set interest rate for the duration of the mortgage, whereas variable mortgages change in line with the Bank of England base rate.Fixed rates are typically lower than variable rates, but they can be more difficult to qualify for.Fixed-rate mortgage rates stay the same for the life of the loan, while variable-rate mortgage rates change periodically according to market conditions.

- Repayment mortgages require you to repay your loan in full at some point in the future, while interest-only mortgages only require you to pay off the interest on your loan each month, meaning that you do not need to make any repayments until you sell your house or die (whichever comes first).

Comparison of Mortgages

Fixed mortgage rates are usually lower than variable mortgage rates, but they come with more restrictions in terms of how much the borrower can borrow and how often they can pay off their loan. A fixed mortgage usually offers a lower monthly payment than a variable mortgage because it is set at a certain amount instead of being based on current interest rates.

Variable mortgages are more flexible in terms of what they offer borrowers because they allow them to adjust their payments to match their current financial situation instead of having to follow strict guidelines on what is allowed under the terms of their loan agreement.

If you are looking for a low interest rate, then a conventional mortgage might be your best option. However, if you are looking for more flexibility and want to pay off your loan sooner, then an adjustable rate mortgage might be what you need.

Security & Advantage of Mortgages in the UK

A mortgage allows you to borrow money from a bank in order to buy something like a house or car. The bank agrees to lend you the money and charges interest on the amount of money it lends you.

The advantages of mortgages include:

- They allow people with low incomes and bad credit histories to buy homes

- They allow buyers who don’t have enough cash on hand for the down payment

- They can be used as collateral

Mortgages in the UK are now more secure and advantageous than ever. The rules of mortgage lending, which came into force on 1 January 2016, have been designed to make sure that lenders only offer mortgages to people who can afford them. This means that borrowers will be able to enjoy a better quality of life as they will not have to worry about their mortgage repayments.

How To Choose Your Mortgage Wisely

The mortgage is one of the most important financial decisions you will make in your life.

There are a lot of factors to consider when choosing your mortgage, including the type of mortgage, interest rates, and whether or not you have a down payment.

You should also consider how much home you can afford to buy and how much you can put down on the home. The more money you put down, the lower your monthly payments will be.

In nutshell, mortgage is a great investment, but it is important to choose wisely.

When you are looking for a mortgage, you should consider the following:

- The interest rate of the loan.

- How much money you want to borrow.

- Length of the loan (30 years or 15 years).

- How much money your monthly payments will be.