How UK Property Prices & The Economy Is Affecting Your Decision To Get A Mortgage

Table of Contents

ToggleHow UK Property Prices & The Economy Is Affecting Your Decision

In the UK, property prices have become unaffordable for many people. The average price of a home in England is £229,000. With the current economic climate and uncertainty, it is not surprising that people are less inclined to get mortgages.

The mortgage market is changing. The UK property prices are skyrocketing, while the economy is slowing down. In order to make a decision, it’s important to know what your options are and how they work.

The UK property market is currently in a state of flux. The economy is booming, with low interest rates and high employment levels, which has led to a rise in property prices.

The UK housing market was one of the most robust in Europe, but with Brexit, the pressure on house prices and mortgage rates has increased. If you are considering getting a mortgage now, or are looking for advice on what to do next, then you should speak to your lender about your options. There are various mortgages on the market that offer different rates of interest and different repayment periods, so it’s important to find out which option suits you best.

The Economic Reality of UK Property Prices & Mortgage Requirements

The economic reality of UK property prices and mortgage requirements is a topic that has been heavily debated for many years. The UK property market is one of the most expensive in the world, with average house prices being more than 10 times the average salary.

UK property prices have been steadily increasing for the past few years. The average house price in London is £463,000.The minimum income required to buy a property in London is £100,000 per annum.The average salary in London is £35,000 per annum.

In order to purchase a property in London with the current mortgage requirements, you would need to save up for a deposit of at least £150,00 and have an annual salary of at least £100,000. This puts many people out of reach from being able to own their own home because they may not be earning enough or saving enough money to be able to afford it on their own.

The Impact of the Economy on UK Property Prices

The property market is a key indicator of the health of an economy. The economic downturn in the past couple of years had a significant impact on property prices, and they have only recently started to recover.

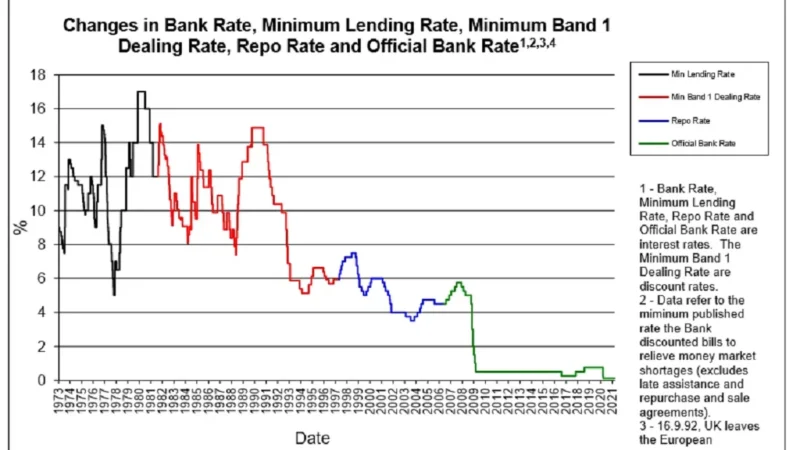

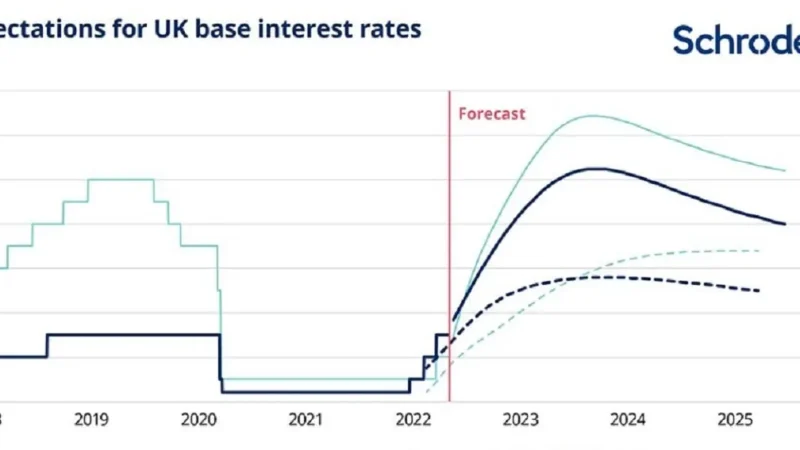

A rise in mortgage rates could have an adverse effect on this recovery, as it would make it more expensive for people to buy houses and would therefore put pressure on house prices. The housing bubble burst and prices dropped significantly. In 2008, the UK property market was worth £1.7 trillion, but by March 2013 this had fallen to £1.3 trillion as a result of the economic downturn.

The recent economic slowdown of 2022 has had a significant impact on the UK property prices. The average house price in the UK is now £269,000. This is significantly lower than predicted in 2007 when it was expected to be around £300,000 by 2022. There are many factors that have contributed to this fall in house prices including low interest rates and Brexit uncertainty as well as a general feeling of unease about the economy and personal finances.

What are the Current Mortgage Requirements in the UK ?

Mortgage requirements are the criteria that lenders use to decide whether or not they will lend you money for a mortgage.

The main requirements are:

- A deposit of at least 5% of the purchase price

- A good credit rating

- Stable income

The mortgage market in the UK has been subject to a number of changes in recent years. These changes have made it more difficult for first-time buyers to get on the property ladder, but they have also encouraged many people to save up for a deposit and buy their own home.

Many of these changes are due to the Mortgage Market Review (MMR) which was introduced by the Financial Conduct Authority (FCA). The MMR was designed to make sure that consumers were better informed about the risks involved with mortgages and that lenders were not making irresponsible loans.

There are four main criteria that borrowers need to meet when applying for a mortgage in the UK:

- They must be over 18 years old

- They must be able to provide proof of employment or self-employment

- They must have enough money for a deposit

- They must show evidence of adequate living accommodation

Conclusion: How Higher Rates and House Prices Impact Your Decision to Buy A Home

In the UK, property prices have been on the rise for a long time now. This has led to higher rates for mortgages and consequently, house prices are also on the rise. For example, a house worth £150,000 in London should cost £120,000 in Birmingham. However, a house worth £250,000 in London would cost around £180,000 to buy in Birmingham.

It is not surprising that people are trying to find ways to make their money go further. One way is to buy a home and rent it out for more than they are paying for it. This way they can cover their mortgage repayments and have some extra income every month as well.