Mortgage Interest Rates UK Last 20 Years

Table of Contents

Toggle20 Year Fixed Rate Mortgage UK-

The past 20 years have been a period of significant change for the UK mortgage market, with interest rates fluctuating and mortgage products evolving to meet the changing needs of consumers. This blog post will explore the history of UK mortgage interest rates over the past 20 years, from 2003 to 2023.

2003-2008 – Interest rates on the rise

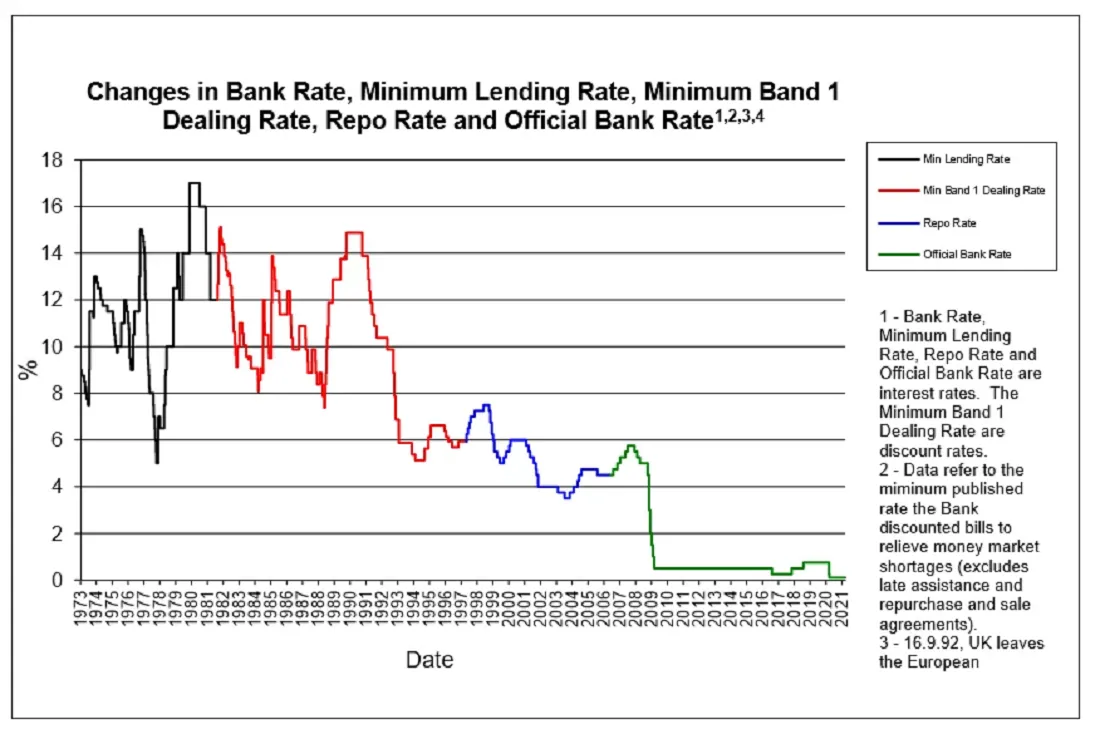

At the start of the 21st century, the Bank of England base rate stood at 4.00%. Mortgage interest rates were higher than this, with the average rate for a two-year fixed-rate mortgage being 5.23% and the average rate for a five-year fixed-rate mortgage being 5.82%. Interest rates were rising, with the Bank of England raising rates several times between 2003 and 2007 to combat inflation.

2008-2009 – The financial crisis

The global financial crisis of 2008 significantly impacted the UK mortgage market. The Bank of England reduced the base rate from 5.00% in October 2008 to just 0.50% in March 2009 to stimulate the economy. Mortgage interest rates aligned with the base rate, with some lenders offering fixed-rate mortgages at under 3%.

2010-2016 – Low-interest rates

Following the financial crisis, interest rates remained low for several years. The base rate stayed at 0.50% until August 2016, and mortgage interest rates remained low. Some lenders offered fixed-rate mortgages at less than 2%, making it a good time for homeowners to remortgage and lock in a low rate.

2016-2018 – A brief rise

In 2016, the Bank of England reduced the base rate to a historic low of 0.25% in response to the Brexit vote. However, rates began to rise again in November 2017, with the base rate increasing to 0.50%. Mortgage interest rates followed suit, with some lenders increasing their rates in response to the base rate rise.

2019-2021 – Low rates return

Interest rates remained low for the past few years, with the Bank of England base rate staying at 0.75% until March 2020, when it was reduced to 0.25% in response to the COVID-19 pandemic. Mortgage interest rates were similarly low, with some lenders offering fixed-rate mortgages at less than 1.5%.

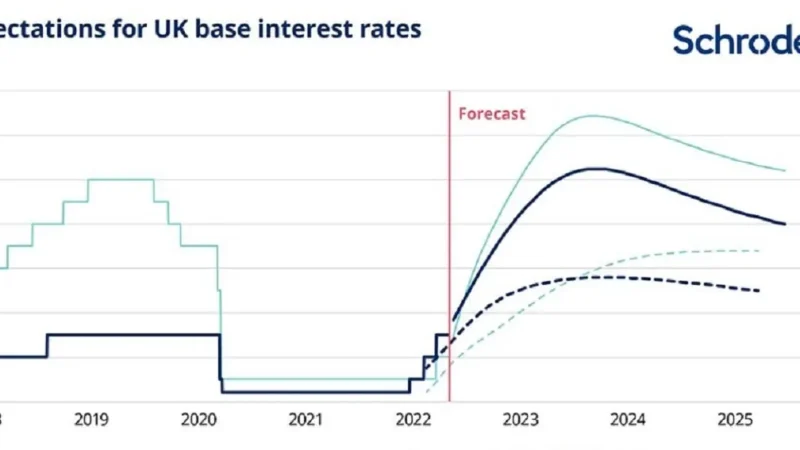

2021-2024 – Uncertainty

As of early 2023, interest rates remain low, with the Bank of England base rate at 0.10%. However, the market has significant uncertainty due to ongoing economic disruption caused by the pandemic. Some lenders have increased their rates in response to inflationary pressures, while others continue to offer competitive deals to attract customers.

Conclusion

Over the past 20 years, the UK mortgage market has seen significant changes in interest rates, with highs and lows reflecting economic conditions and government policy. The global financial crisis of 2008 and the COVID-19 pandemic have significantly impacted the market, with low-interest rates being used to stimulate the economy. Overall, the past two decades have been characterized by low-interest rates, making it a good time for homeowners to remortgage and lock in a low rate. However, as we look toward the future, it remains to be seen how interest rates will change and how the mortgage market will continue to evolve to meet the changing needs of consumers.