UK Economic Crisis 2023-2024: Effect on GDP, Mortgage and Housing Market

Table of Contents

ToggleUK Economic Crisis 2023-2024

The UK financial crisis in 2022-2023 is a result of the UK’s inability to adapt to the changing global economy.

The UK has been unable to adapt to the changing global economy and has been left behind as other countries such as China have been able to make further progress. The economy is in a state of decline. The unemployment rate has risen to over 30% and wages have been stagnant. The government has imposed a strict austerity plan that has led to the decline of public services and infrastructure.

Is a new economic crisis coming for UK? Yes, the UK economy is expected to be in a state of crisis for the next year or even after that. It will be difficult for consumers to find jobs and difficult for businesses to grow. It will also be hard for the government to raise taxes on high earners and corporations because of how much the economy has already shrunk.

UK Recession 2022-2023 Housing Market

UK housing market is expected to go through a recession in 2022-2023.There are many causes of. The main cause is the lack of affordable housing. The government has been trying to solve this problem by speeding up housebuilding, but it hasn’t worked well enough.

The recession will lead to more people struggling to afford homes and increase demand for cheaper properties in London and other cities with large populations.

UK Recession 2022-2023 Mortgage market

The UK mortgage market is expected to be in crisis by 2022-2023 due to UK recession 2023. This is because the number of people who want to buy property has decreased, and this results in a decrease in the amount of mortgages being issued.

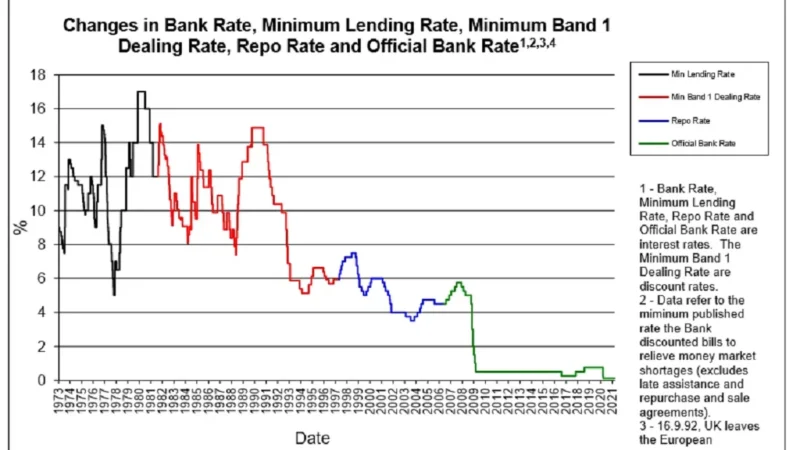

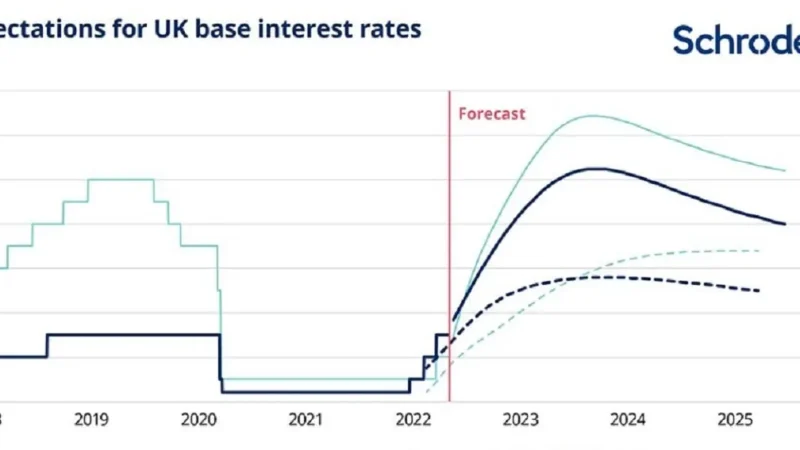

The UK mortgage market is predicted to be in decline over the next three years as well. The country is still struggling with high unemployment, low wage growth and an uncertain future for UK mortgage rate.

The Bank of England has forecast that house prices will decline by up to 10% over the next two years. This will result in an increased number of people being unable to afford their mortgages, resulting in a higher number of repossessions and fewer new home purchases.

The number of people who take out mortgages is expected to decline by an average of 10% each year until 2022, which will result in a drop of £30bn worth of mortgages by 2023.

The UK economy is predicted to see a recovery by 2023, with 1 million jobs added over this period and £1 trillion invested into the housing market.

Where is UK GDP 2022-23 going?

GDP forecasts are a key indicator of future economic performance. They help us to understand the current state of the economy, and project how it will change in the future.

We should not think of these forecasts as predictions – they are just projections based on data we have today. We cannot predict what will happen tomorrow with any certainty, but we can make informed decisions based on these projections.

UK GDP 2022 is expected to grow by 2.6%. This is 0.3% lower than the previous forecast in 2018 and reflects a slowing economy since Brexit.

As per UK economy news, the UK’s GDP will be worth $2.15 trillion by 2022-23, which is an increase from the current $1.87 trillion and $1.81 trillion in 2020 and 2019 respectively.

The UK economy has experienced an economic boom over the past decade, with GDP increasing from $2 trillion to over $2.15 trillion by 2022, according to projections from the Office for Budget Responsibility (OBR).The OBR predicts that growth will continue, but at a slower rate than previously expected due to Brexit uncertainty and rising inflation rates.

Takeaway:

The mortgage market in the United Kingdom has been a challenging one for the past few years. The mortgage market is expected to experience another recession during the period of 2022-2023. This will be caused by a significant rise in unemployment rates followed by higher interest rates and lower property values.